Big Government is big, But is it Good enough?

This is the second in our series of articles excerpting our recent report, Financing the Public Sector in Nigeria: Issues and Prospects. Our focus will be on the efficiency of public expenditure.

Government spending is typically divided into recurrent and capital streams. Recurrent expenditures represent claims on government expenses like salaries while the latter represent investments capable of later appreciation or generating future returns. Some examples of capital projects include new roads, physical buildings and information technology infrastructure.

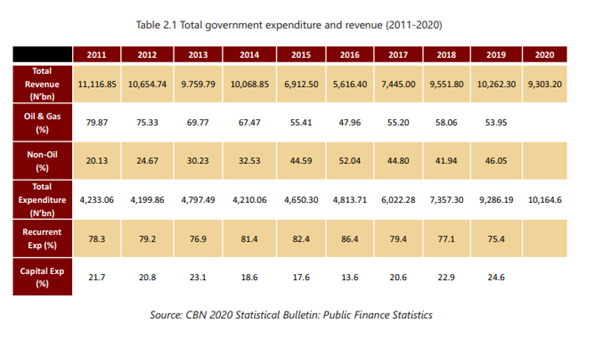

An expanding economy requires continued capital investments. Nigerian public finances are persistently menaced by the cyclical nature of their crude oil mainstay. That primary problem is exacerbated by the shadow of ballooning recurrent spending at the expense of capital expenditure.

The policy solution favoured by the government to address the gnawing gap between revenue and expenditure has been to resort to debt instruments and deficit financing. That solves little unless root inefficiencies are addressed. The debt service costs only end up as another line in the recurrent expenses ledger.

Efficiency: A Missing Watchword

The Nigerian government is seemingly everywhere and nowhere. It is the largest employer of labour in the country, and there are, seemingly, infinite government agencies.

In 2019, the Federal Government spent N388.7bn and N593.33bn on healthcare and education respectively. For context, in that same year, the Federal Government spent N2.1tn on debt servicing. In other words, expenditure on healthcare and education was 48% of the amount used to pay bondholders.

Despite the stark contrast between spending on vital public goods and debt service cost, those figures marked a decade-high investment from the State between 2009 and 2019. In 2009, the Federal Government spent N137.12bn on education while spending N90.2bn on healthcare. At no point during this period did the Federal Government spend 1% of GDP on either public good. The highest achieved for education was 0.527%, while its counterpart for healthcare was 0.364%. Both highs occurred in 2011.

The resources that are not spent on public goods bolster that bane of civil service reform committees called government bloat. The Orosanye Committee, issued a clarion call for the importance of a leaner, streamlined bureaucratic apparatus. That has not been heeded as redundant agencies, parastatals and commissions continue to exist.

The legacy of the creation of new states and government attempts to run businesses in the 1970s is a gargantuan bureaucracy.

The public sector in Nigeria struggles to properly account for its numbers or regulate its spending. According to our Report, there were over eighty four thousand ghost workers on the payroll of the Nigerian civil service between 2014 and 2016. McKinsey (2019) estimated that the government could save as much as $3 billion by 2030 in public benefits if this leakage is reduced.

The State exists to serve the people and not the people to serve the State. That much seems self-evident. Therefore, citizens must ask cui bono? Who gains if Nigerian governments continue stacking up debt service costs at the expense of necessary capital investments and those public goods we term the ‘dividends of democracy’?

Which way, Nigeria? Obajana or Dangote; NITEL or MTN?

Nigeria caught the developmental State bug in the throes of our first oil boom. Dr Ngozi Okonjo-Iweala wrote: ‘Between 1973 and 1999, the Federal Government of Nigeria invested the equivalent of about US$100 billion in 590 public enterprises, 160 of them commercial, in virtually every sector of the economy, from petroleum refineries to flour mills, from telephone and electric power companies to radio stations, from oil palm plantations to car assembly plants’. State-owned enterprises, at their height, approached 35% of national GDP.

All that spending bought Nigerians was our first experience with the crushing burden of debt obligations and a global reputation for corruption.

This cannot be gainsaid: we did not become the USA, Japan, China, not even South Africa. We now compare unfavourably with past peers like Indonesia and Malaysia.

The symbols of that era of State largesse are Ajaokuta Steel Mill, Nigeria Airways, Nigerian Telecommunications Limited (NITEL) and the Nigerian National Petroleum Corporation (NNPC). As we emphasized in the Report: The drain on government finances is not due only to grants and allocations to the SOEs, but also to their inability to be self-sustaining and contribute to government revenues through taxes, dividends, royalties, licenses, etc.” It is shocking that in 2021 when the federal government borrowing was so high, the Chairman of the Fiscal Responsibility Commission, Victor Muruako, reported that about 1.5 trillion Naira operating surpluses had not been remitted to the federal purse by ministries, departments and agencies.

The failure of the state owned enterprise, NNPC, to maintain a refining capacity equal to national demand has hung the albatross of imported petroleum, subsidies and the debt used to finance said subsidies on the necks of present and future Nigerians. The NNPC operates four of its refineries with an installed capacity of 445,000 barrels per day at 15% capacity despite the massive fortune invested by the State. Nigeria imports over 80% of its refined petroleum needs.

A Tale of Two Corporations

The NNPC was established in 1977 as part of the wave of resource nationalisation among members of the Organisation of Petroleum Exporting Countries (OPEC). Its commercial legacy has been mixed. While its contributions to the national exchequer cannot be dismissed, it has failed to become a consistently profitable commercial concern. Its profits in 2020 were the rare green spot in a sea of red ink.

One major benefit attributed to SOEs is their broader contribution to national development free of supposed commercial short-sightedness. That positive is not much visible in the operations of the NNPC. Its refineries are characterised by their idleness. It has also failed to deliver cheap energy to Nigerians. Recurrent scarcity and price increases are familiar features to consumers in Nigeria.

A comparison of NNPC with Saudi ARAMCO, the trillion-dollar crown jewel of Saudi Arabia, yields the following data. The NNPC has a production capacity of 2.5 million barrels per day. Saudi ARAMCO, in contrast, helms production of 9.2 million barrels per day. The total assets of NNPC in 2020 was N15.8bn ($41.4m), while Saudi ARAMCO weighed in at $510.4bn. That figure has only risen since its initial public offering. In 2020, the Saudi giant had a net income of $49 billion and paid dividends worth $70 billion.

NLNG was incorporated in 1989 as a limited liability company and has been contributing to public finances ever since. It is a joint project of NNPC (on behalf of the Federal Government), Shell, Total and ENI-AGIP. The latter hold stakes worth 25.6%, 15% and 10.4% of the company respectively. The NLNG (Fiscal Incentives, Guarantees and Assurances) Act of 1990 stipulates that the company is an ‘independent, autonomous commercial entity and its operations, policies, procedures and conditions of services shall be determined by the Board of Directors of the Company’. According to the Managing Director, three things account for its success: the NLNG Act, the shareholding structure (NNPC does not have a majority shareholding) and the governance structure of the company.

Since its inception, it has paid $18 billion in dividends to the NNPC, $9bn in taxes and reduced gas flaring from 65% to 20% in Nigeria. While other SOEs are a drain on public finances, NLNG has been crown jewel.

Conclusion

The focus of this article has been the important question of government expenditure. Politicians, as is their wont, will make many promises in this campaigning and election season. When public expenditure is inefficient, citizens pay by enjoying inferior goods. Consider that the Academic Staff Union of Universities (ASUU) went on what ended up being an 8 months-long strike that endangered the future of Nigerian public university students and the prospects of future taxpayers. While the government scrambles to keep subsidy payments going, it does not expend enough on education.

The Nigerian government has inherited a statist legacy that is at odds with a competitive economy. There is a need to inject competition into sectors dominated by stagnant State-owned enterprises and stop the allocations and grants to SOEs and instead collect revenues through taxes, royalties, licenses, etc. from these organizations. While NITEL was a colossal drain on public resources, the firms in the telecommunications sector in Nigeria today are contributors to public finances.

Candidates for political office in the upcoming elections must articulate their plans to restructure the extant fiscal regime. Will they opt for the privatisation or commercialisation of existing SOEs and government monopolies? How can they increase capital expenditures viz a viz current expenditure with a high debt burden?

Public expenditure reform is unavoidable. The private sector has thrived in industries ranging from banking to telecommunication. The most efficient use of public revenue is investments in areas that improve social welfare like healthcare, education and infrastructure. Eliminating government bloat and reducing government participation in commerce are also a good way to bolster efficient and judicious management of public finances.

Appendix

1. Danne Institute for Research. ‘Financing the Public Sector in Nigeria: Issues and Prospects’. Lagos, Nigeria: Danne Institute for Research, June 2022.

2. ‘Fuel Scarcity: Reps Urge NNPC To Open More Stations’. Accessed 1 July 2022. https://leadership.ng/fuel-scarcity-reps-urge-nnpc-to-open-more-stations/.

3. National Bureau of Statistics. ‘Nigerian Gross Domestic Product Report Q1 2022’. Abuja, Nigeria: NBS, May 2022.