Nigerian States: Important yet Insolvent

Introduction

There is more to the government than the Federal Government. The Nigerian so called Federation comprises a federal government and federating subnational units. Those sub-nationals are called states and local government areas.

This article, the third in our series excerpting our report Financing the Public Sector in Nigeria: Issues and Prospects, will examine the finances of the sub-nationals in the Federal Republic of Nigeria.

Ours is a federation of 36 states, a self-governing capital territory and 768 Local Government Areas(LGAs). The states and LGAs are closer to the people than the federal government. Each tier of government has responsibilities stated in the Constitution. They must be viable to carry out their constitutional duties.

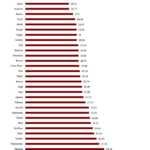

The primary characteristic of the states is financial dependence on the Federal Government. Lagos state is an exceptional case of fiscal autonomy. Federal allocations accounted for a mere 21.67% of its total revenue in 2020. That is in marked contrast to the other subnationals. They relied on Federal allocations for between 42.15% to 86.4% of their revenue in 2020.[1]

States rely on their share of 26.72% of monthly revenues accruing to the Federation Account, a two per cent education tax levied on registered Nigerian companies, Personal Income Tax, non-company Withholding Tax, non-company Capital Gains Tax, non-company Stamp Duty, Gaming and Gambling Tax, Road Tax, Business Premises Registration Tax, Developmental Levies, Street naming levies in the state capital, Urban Right of Occupancy fees and Market taxes for markets financed by state governments.

Their local government counterparts rely on 20.6% of the monthly revenues accruing to the Federation Account, taxes on shops and kiosks within their LGA, tenement rates, liquor licence fees, slaughter slab fees, marriage registration fees, birth registration fees, death registration fees, street naming fees in the LGA and Right of Occupancy taxes for rural lands within the LGA.

Our report presented an overview of the historical development of subnational finances in Nigerian history. This article will restrict itself to events in the Fourth Republic.

[1] Danne Institute for Research, ‘Financing the Public Sector in Nigeria: Issues and Prospects’ (Lagos, Nigeria: Danne Institute for Research, June 2022), 39.

Abuja Has All the Funds

The reality of Nigeria today is that a significant chunk of public sector revenue is associated with income from mineral extraction. This helps us understand the nature of the reliance of states on the Federal purse.

The current revenue allocation formula splits revenues in the Federation Account into 52.68%, 26.72% and 20.6%. Those belong to the Federal government, states and LGAs respectively. A recent proposal hopes to change that allocation to a 45.17%, 29.79% and 21.04% split.[1]

In the Fourth Republic, the largest sources of subnational revenues are Federation Accounts Allocation Committee (FAAC) disbursements, Internally Generated Revenue (IGR), Value Added Tax (VAT), grants and occasional bonuses during oil booms. Our analysis examined the first 14 years of the Fourth Republic and discovered that FAAC allocations accounted for 58.21% of total subnational revenue. IGR, in contrast, was a distant 14.85%. Grants accounted for 7.72%, while, from 2007, excess crude oil revenue came to account for 3.97% of subnational income.[2]

States and local governments are the tiers closest to the people. They are the frontline in the allocation of public services such as healthcare and education. They are also large employers of labour. Further, their primary role in intra-state road and market construction makes them indispensable to the free-flow of commerce in the agricultural sector where most Nigerian labour is concentrated. That makes their heavy reliance on the cyclical Federal revenue dangerous.

[1] ‘FG Allocation to Shed 3.33% in New Revenue-Sharing Formula — Business — The Guardian Nigeria News – Nigeria and World News’, accessed 4 July 2022, https://guardian.ng/business-services/fg-allocation-to-shed-3-33-in-new-revenue-sharing-formula/.

[2] Danne Institute for Research, ‘Financing the Public Sector in Nigeria: Issues and Prospects’, 42.

VAT: The Rising Star

Section 162(2) of the Nigerian Constitution enshrines the principles of population, equality of states, internal revenue generation, land mass terrain and population density as the fundamental principles guiding the allocation of Federal revenues. That principle justifies oil-producing states subsidising more populous, and often poorer, Nigerian states. However, that ideal has caused friction over disbursements from VAT receipts.

The Rivers state government sought legal clarification over who has the authority to collect Value-Added Tax in its territorial jurisdiction. That move was an attempt to deny that revenue stream to the Federal Inland Revenue Service (FIRS) and, consequently, the Federal Accounts Allocation Committee. The matter is up for consideration before the Supreme Court of Nigeria after a Court of Appeal ruling on 10th September that reversed an August 9, 2021 High Court ruling in favour of the Rivers state government.

The present distribution formula for VAT income is 15% to the Federal government, 50% to the states, 35% to the LGAs and 4% as a collection fee for the FIRS. As with oil revenues, there is an acknowledgement of the fact that a few states subsidise the rest. As such, 20% of the revenue is assigned to a common pool and divided based on derivation.

As of 2019, disbursements from VAT accounted for at least 20% of the revenue of the majority of Nigerian states. In contrast, in Rivers and Lagos states, which account for a large percentage of VAT revenue, it was 9.27% and 19% of their revenue respectively.[1] VAT is an important revenue stream for all the governments of the Federation because, unlike the crude oil mainstay, it is not cyclical. That is what makes the Rivers state campaign through the courts to reclaim VAT receipts as a state monopoly important.

The Federal High Court ruling of August 9, 2021 emboldened the governors of Rivers and Lagos states to sign into law bills that appropriated the VAT receipts in their states for their exchequers. If the Supreme Court accedes to the High Court ruling, that would be a watershed moment in the history of public sector financing in Nigeria. States with vibrant commercial sectors will once more be the winners. Others will suffer, at least in the short term.

The signal lesson that less prosperous states should take is the ephemeral nature of external revenue and the importance of internally generated revenues. Just like Federal allocations are prone to wax and wane, the VAT lifeline might prove to be equally transient. States have fiscal obligations, not least of which are the provision of public services and payment of staff salaries. They must boost their guaranteed revenue or tailor their expenditure to their resources.

[1] Danne Institute for Research, 49.

Debt, CAPEX & IGR

Capital expenditures are a vital component to the expansion of the economy through the provision of public goods. Subnational government capital expenditures are an important counterpart to Federal spending. As of 2019, only five of the 36 states spent more than 50% of their budget on capital expenses. 10 out of 36 spent above 40% while 18 out of 36 spent above 30%. In contrast, only three out of 36 states spent below 20% of their budget on capital expenditures. The states in question are Taraba (11%) Benue (14%) and Oyo (19%).[1]

Between 2015 and 2019, total recurrent expenditure by states rose from 65.36% of their total expenditure to 72.90% while capital spending dropped from 34.64% to 27.10%.[2] The importance of subnational spending to infrastructural improvements, education and health, etc. makes this a worrisome trend.

Like the federal government, the states have resorted to deficit financing to make up for low revenue generation capacity. Subnational debts hold a sovereign guarantee. That means that the Federal Government of Nigeria guarantees their repayment. In 2020, the Debt Management Office (DMO) instituted debt ceilings that prevented states from having debt burdens of more than 50% of their revenue in the preceding fiscal year. That debt ceiling has shackled subnational adventurism in the debt markets. The three states with the highest debts raised in foreign capital markets are Lagos, Kaduna and Edo. Lagos State is also in the lead in the domestic markets. It is followed by Rivers and Delta States.

Given the fiscal ceiling on debt market access imposed by the DMO and the cyclical nature of FAAC allocations, raising the IGR of states is an important lever for the management of their finances. The advantages of increased IGR rebound on states due to improved access to debt markets for capital expenditures and a higher budget. Lagos state stands as an exemplar being the IGR powerhouse of the Federation since it raises the most income internally.

We found only one star performer in the IGR adequacy index developed for our report. This Index measures a state’s ability to cover recurrent expenditure with internally generated revenue alone. Rivers State had an IGR Adequacy of 123% in 2019. Lagos State in second at 72% and Ogun State was third with 66% IGR Adequacy. Kaduna and Enugu States were also creditable performers with 52% and 50% respectively. The absolute worst performers were Taraba, Bayelsa and Gombe. Their IGR could cover less than 15% of their recurrent expenditure.

[1] Danne Institute for Research, 53.

[2] Danne Institute for Research, ‘Financing the Public Sector in Nigeria: Issues and Prospects’ (Lagos, Nigeria: Danne Institute for Research, June 2022), 54.

Conclusion

The central questions that arise from this article revolve around the nature of our present government structure. Do we need an overweening central government apparatus or should the subnationals be empowered? How can subnational revenues be bolstered so as to permit them to carry out effectively their constitutional duties to Nigerians? We think that those questions should be at the forefront of all policy discussions in the forthcoming elections.

The enduring problem of Nigerian subnationals is the challenge of ensuring adequate and sustainable revenue streams. A swift way to bolster the revenue streams of subnationals could be granting them control of the minerals extracted in their territories. Not all Nigerian states have crude oil. But states, like Ondo state with its bitumen reserves, will be forced to encourage emergent industries when their income is tied to its development.

Local governments are the closest tier of government in the rural areas where millions of Nigerians still live. In our examination of the years 2009 to 2019, we found that FAAC allocations accounted for 61.44% of LGA revenue. VAT allocations were next at 18.40%. Their IGR was 2.16% while state allocations accounted for 0.99% of their revenue intake. The average recurrent expenditure was 80.93%. This is unacceptable given their importance especially to rural communities which are vital for national food security.

Raising the profile of LGAs and highlighting their importance as tools for public service delivery should play an important role in developing the role of subnationals for national development.

States are miles away from reducing their dependence on Federal allocations. But if the states are crawling, LGAs are still in utero. The economic progress of the Federal Republic of Nigeria requires that all its governments run, that they work for the benefit of the citizens.

Appendix

- Danne Institute for Research. ‘Financing the Public Sector in Nigeria: Issues and Prospects’. Lagos, Nigeria: Danne Institute for Research, June 2022.

- ‘FG Allocation to Shed 3.33% in New Revenue-Sharing Formula — Business — The Guardian Nigeria News – Nigeria and World News’. Accessed 4 July 2022. https://guardian.ng/business-services/fg-allocation-to-shed-3-33-in-new-revenue-sharing-formula/.