National Digital Identity: Making Nigerians Legible

As at March 2021, over 51 million people have registered and have their National Identity Number (NIN). All those who have phones (SIM cards) have to register or lose their numbers. McKinsey & Company in their 2019 Report estimate that Nigeria could grow its GDP by 7 per cent ($59 billion) in 2030, attract investment worth $21 billion from financial inclusion, create over 1 million jobs from digital contracting, and save over 1.8 billion man hours through streamlined e-government services if it successfully creates a national digital identity database for its 200 million citizens.

Apart from the value added to individuals and businesses, government stands to benefit from a central digital identity database through improved public service delivery, improvements in the security of lives and property in the country, increased revenue from leakages plugged, efficient tax collection and greater labour productivity.

The Lagos state government, for example, has deployed the use of cameras to catch traffic offenders. Tickets are sent directly to the given addresses of offenders. This was made possible by, among other things, the drivers’ licence and car registration database of the Federal Road Safety Corps.

However, Nigeria is yet to integrate its identity databases administered by 12 government agencies. This has to change going forward if the country is to enjoy the benefits of digital identity.

National digital identity for the benefit of all

A national digital identity system holds a lot of promise for individuals as well as public and private institutions in Nigeria. The McKinsey report explains that individuals can use digital identification to interact with and benefit from other individuals, governments and businesses in six capacities: as consumers, workers, microenterprises, taxpayers and beneficiaries, civically engaged individuals, and asset owners. Public and private institutions can relate with an individual’s identity as: commercial providers of goods and services, employers, public providers of goods and services, governments and asset registers.

One of the specific benefits of a national digital identity to individuals, according to the Report, is financial inclusion due to rise in fulfilment of banks’ KYC requirements and ability to remotely register and enjoy financial services. Over 50 per cent (about 60 million) of Nigeria’s adult population are unbanked according to World Population Review and the Central Bank of Nigeria hopes to reduce it to 5 per cent by 2024. The World Bank believes that a scaled national digital identity programme is Nigeria’s best bet to achieving this, considering that 125 million Indians left the unbanked pool in just 12 months through the country’s Aadhaar, a nationwide digital identity programme.

Digital talent matching and contracting platforms, which are enabled by digital ID, also improve access to employment. Unemployment is a peculiar problem in Nigeria as over 33 per cent of the country’s labour force is unemployed, 42.5 per cent of whom are young people. If well implemented, the McKinsey study projects a 1.8 per cent boost in productivity for Nigeria’s existing workers owing to increased access to the formal sector and better matching of skills with jobs.

Agricultural productivity due to formalised landownership is another benefit to individuals. McKinsey estimates show that nearly 90 per cent of land titles are not formally registered in the country. A national digital identity for players can begin to unlock the latent potentials in the sector.

The Report identifies digital identity’s five largest sources of value for private and public institutions as cost savings, reduced fraud, increased sales of goods and services, improved labour productivity, and higher tax revenue. It estimates a 90 per cent reduction in cost in customer onboarding and also a reduction from days or weeks to minutes for customer-institution interactions for private institutions that use a dependable digital identity database, instead of physical branches. It also increases the uptake of goods and services and powers the emerging digital gig economy platforms. Government planning and budgeting is easier and more targeted.

Digital identity can also reduce fraud on several fronts, from payroll fraud to identity and tax fraud. The report states that the Ministry of Finance removed 84 thousand ghost workers from the federal civil service payroll and estimates that the Nigerian government could reduce leakage in public benefits alone by $3 billion by 2030 and save $350 million from preventing government payroll fraud if it successfully adopts a national digital identity programme. Furthermore, as cities become smart, a unique identity system makes it easier to identify robbers, terrorists and other criminals. Nigeria’s quest to link SIM cards to the NIN hopes to achieve this. 143 million out of the 207 million active SIM cards have now been linked as at January 2021.

The various benefits notwithstanding, the digital identity adoption rate in Nigeria was less than 10 per cent as at 2019 according to the McKinsey Report. The National Identity Management Commission (NIMC) as authorised by the NIMC Act No. 23 of 2007 is issuing the National Identity Number (NIN) to Nigerian citizens and residents in a bid to build Nigeria’s digital identity database. As at March 2021, the commission has registered over 51 million people. Monthly enrolment at its 3,800 centres has increased to 2.6 million since the commission took some drastic measures to scale up adoption.

A fragmented landscape

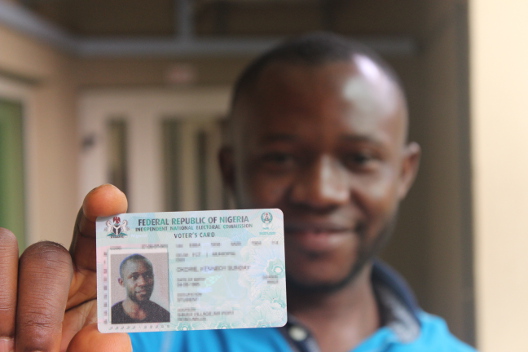

The identity landscape in Nigeria is however fragmented. Citizens provide their personal biometric information to several government agencies to access their services. They need a Biometric Verification Number (BVN) to open a bank account, Permanent Voter Card (PVC) to vote, Drivers’ licence to drive, Tax Identification Number (TIN) to pay taxes etc. The cost of this duplication to government is huge and the danger to citizens of multiple identities, considerable. The NIMC, backed by law to harmonise Nigeria’s several databases, has so far partnered with about 13 other identity-managing government agencies such as Central Bank of Nigeria, Joint Admissions and Matriculation Board, Independent National Electoral Commission, PenCom, National Immigration Service, Federal Road Safety Corps, Federal Inland Revenue Service, and National Population Commission; and payment processing giants, MasterCard and Visa. This is a good first step but if this partnership will successfully collapse the proliferated databases into a central one or not is yet to be seen.

What are the dangers?

Without effective built-in privacy provisions and comprehensive legal and governance structure, digital identity is susceptible to misuse. Individuals are vulnerable to identity theft from either public or private organisations that have been granted access to individuals’ identities for the provision of services. Private institutions can misuse the identities with them for economic gains by going beyond what they are supplied for to, for example, market products without consent or regard for individuals’ privacy. Compromised administrators of digital identity database especially in the public sector could use their access to and control over personal data against the interests of individuals. The McKinsey & Company report explains that a digital identity system could make political, religious, racial and economic targeting by a dominant group in power more subtle and efficient. Political dissents and ethnic and religious minorities could be excluded or side-lined by an authoritarian government from accessing critical government or private-sector services. The dangers are real.

It is no wonder that Swiss citizens recently voted against a digital identity system proposed by the government over data privacy concerns. Government can tamper with the digital identity of citizens if they have control over the software. Who owns the software may be important. In a recent interview, Arturo Bris of IMD, Switzerland agreed that there are technological and social controversies around digital identities: technologically speaking, digital identities are controversial because digital identities only work if they cannot be supplanted, and allow individuals to perform multiple activities in the digital domain. Socially, they are controversial because the value of a digital identity is entirely dependent on the access to technology of people – thus poor societies are less likely to enjoy their benefits.

It will probably take years to make Nigerians legible going by the rate of registration for NIN. Nigerians who do not have a phone may have no incentive to register for the NIN. The many advantages of legibility identified in the McKinsey Report may not materialise soon. The mindset of government officials must change if digital identities are to work. The manual system seems to work side by side with the electronic system. Recently, a young lady complained on Twitter that she had gone to one of the telecoms companies to get a micro SIM for her new phone. Her number was already registered on NIN. The officer asked her for a print out of her NIN slip. The customer could not understand why she needed the slip of paper when she had a digital identity. The company apologised on Twitter for the inconvenience and stated: Please be informed that your NIN slip is required for SIM upgrade as a mandatory document by our regulators.” Perhaps Nigeria is far from a truly national digital identity system.